Final Thoughts from the Banking Floor

“A new year will not change your money. Better decisions will. And better decisions start today.”

Get quick access to business loans, competitive savings, and expert financial guidance. Join 5,000+ entrepreneurs who trust us to grow their businesses.

T&G Global Ventures

Earnwell Helped Me manage my finances and target savings which i used to Expand My Motor spar parts shop. They have a very supportive team.

We are committed to providing accessible financial services that empower individuals, small businesses, and communities to achieve their economic goals.

Committed to your financial success

Working together for customer excellence

Financing small businesses in FCT-Abuja

Supporting startups to scale

Financing businesses to scale across Nigeria

Supporting creative entrepreneurs

EarnWell Microfinance Bank is a leading financial institution licensed by the Central Bank of Nigeria, dedicated to providing innovative and accessible financial services to individuals, small businesses, and underserved communities.

Our objective is to foster economic growth by offering tailored financial solutions that meet the unique needs of our customers while promoting financial literacy and inclusion.

Fully licensed by the Central Bank of Nigeria

Tailored solutions for individual needs

Cutting-edge digital banking services

Empowering local businesses & individuals

We offer a comprehensive range of financial products designed to meet diverse needs and help you achieve your financial goals.

Flexible loan options including business loans, personal loans, salary advance, and agricultural loans with competitive interest rates.

Explore LoansVarious savings products including target savings, fixed deposits, and children's savings accounts with attractive interest rates.

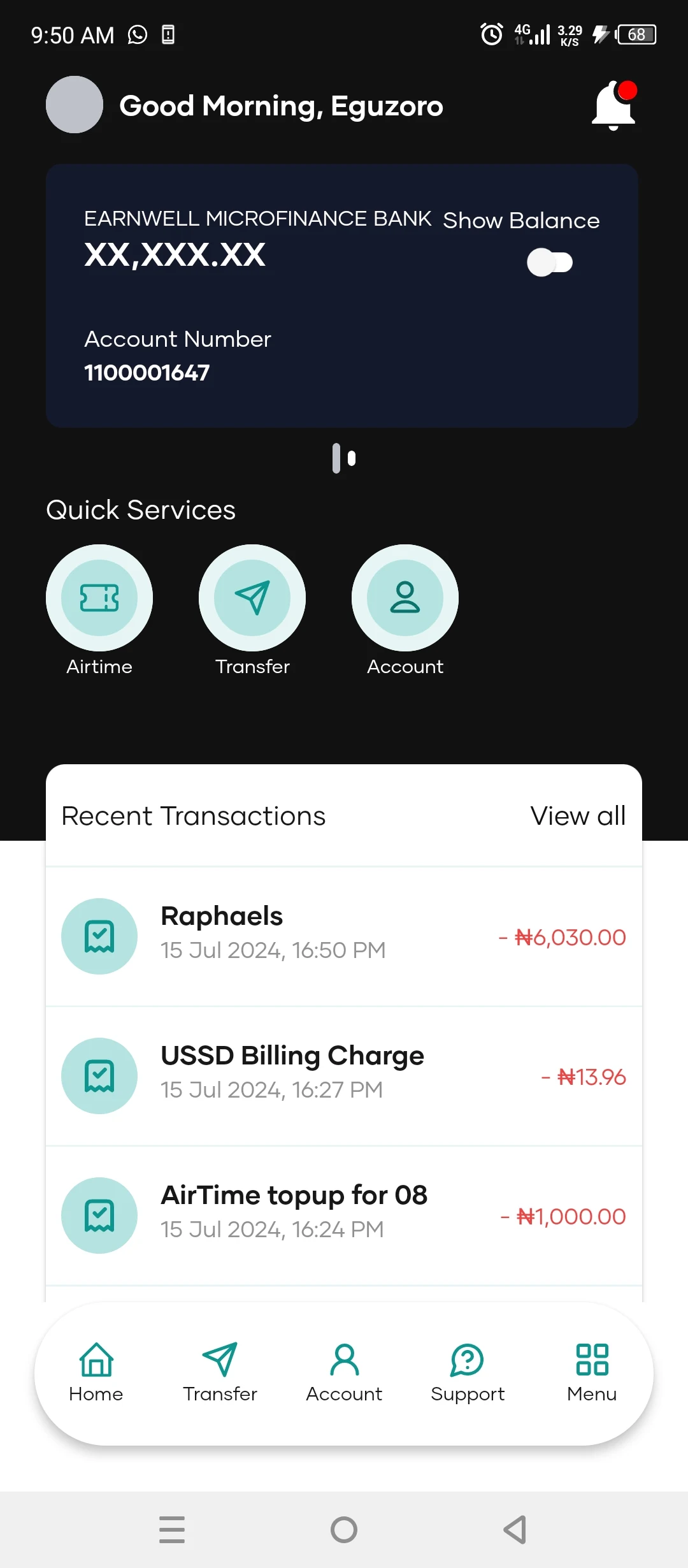

Start SavingConvenient banking through our mobile app, USSD banking, and online platform for 24/7 access to your accounts.

Go DigitalComprehensive banking solutions for SMEs including business accounts, payroll management, and merchant services.

Grow BusinessGrow your wealth with our investment products including treasury bills, mutual funds, and investment advisory services.

Invest NowAcquire assets and equipment through flexible hire purchase plans with convenient payment terms and ownership transfer.

Learn MoreExperience seamless banking with the EarnWell Mobile App. Manage your finances, transfer funds, pay bills, and apply for loans anytime, anywhere with just a few taps on your smartphone.

Send money to any bank in Nigeria instantly

Pay utilities, cable TV, and other bills seamlessly

Apply for loans and get instant decisions

Track expenses with visual analytics

Discover the unique advantages that make us the preferred financial partner for thousands of Nigerians.

Fully licensed by the Central Bank of Nigeria with 11+ years of trusted service in the financial industry.

Committed to serving underserved communities and promoting financial literacy across Nigeria.

24/7 customer support with personalized service to help you achieve your financial goals.

Quick loan approvals and account opening with minimal documentation requirements.

Advanced security measures to protect your funds and personal information.

We reinvest in communities through financial education and support for small businesses.

Join thousands of satisfied customers who trust EarnWell Microfinance Bank for their financial growth and prosperity.

Discover how individuals and businesses across Nigeria have transformed their lives with our financial solutions.

"Earnwell is doing well! Banking with them for six months gave me overdraft access, which helped me restock goods and expand my wholesale business nationwide. They are a truly reliable partner."

Wholesale FMCG Distributor, FCT-Abuja

"Earnwell Microfinance Bank helped me manage my finances and target savings to expand my motor spare parts shop. Their supportive team and seamless loan process made my expansion dreams possible."

Shop Owner, FCT-Abuja

"Partnering with Earnwell Microfinance Bank allowed me to secure loans for new cooling equipments. This improved my food storage and customer service significantly. I am very pleased with their services."

Provision Store Owner, Abuja

"Earnwell helped me expand my boutique. The process was quick, and the team was supportive throughout. Their financial assistance allowed me to increase my inventory and attract many more loyal customers."

Fashion Designer, Kano

Access our wide range of digital banking services anytime, anywhere for seamless financial transactions

Accept payments, make withdrawals, and transfer funds with our secure and reliable Point of Sale terminals. Perfect for businesses of all sizes.

Get your EarnWell ATM card for 24/7 access to cash withdrawals, balance inquiries, and payments at any ATM nationwide.

Bank without internet! Dial our USSD code from any phone to access banking services instantly.

Chat with us on WhatsApp for instant customer support, account inquiries, and transaction assistance.

Find answers to common questions about our services, account opening, loans, and more.

A Microfinance Bank is a financial institution licensed by the Central Bank of Nigeria to provide banking services to low-income individuals, micro-entrepreneurs, and small businesses that typically lack access to traditional banking services.

EarnWell Microfinance Bank is regulated by the Central Bank of Nigeria and focuses on:

Opening an account with EarnWell Microfinance Bank is simple and can be done through multiple channels:

Requirements for individual accounts:

The requirements vary based on the type of account and customer category:

For Individual Accounts:

For Corporate/Business Accounts:

For Joint Accounts:

EarnWell Microfinance Bank offers a comprehensive range of loan products tailored to meet diverse financial needs:

1. Business Loans:

2. Personal Loans:

3. Agricultural Loans:

4. Special Loan Products:

Applying for a loan with EarnWell Microfinance Bank is straightforward. You can choose from multiple application channels:

Application Channels:

Loan Application Process:

General Requirements:

Our interest rates are competitive and vary based on several factors including loan type, amount, tenure, and customer profile. All rates are within the regulatory guidelines set by the Central Bank of Nigeria.

Current Interest Rate Range (as of 2024):

Factors Affecting Interest Rates:

Transparent Pricing: We provide full disclosure of all charges including processing fees, insurance, and any other costs before you accept the loan.

EarnWell Microfinance Bank offers multiple convenient channels for making deposits into your account:

1. Branch Deposits:

2. Digital Channels:

3. Agent Banking:

4. Other Methods:

Deposit Limits:

Yes! EarnWell Microfinance Bank provides multiple digital platforms for 24/7 account access:

1. EarnWell Mobile App:

2. Internet Banking:

3. USSD Banking:

4. WhatsApp Banking:

Security Features:

Our minimum balance requirements are designed to be accessible while encouraging regular savings. Requirements vary by account type:

1. Regular Savings Account:

2. Target Savings Account:

3. Children's Savings Account:

4. Corporate Savings Account:

5. Fixed Deposit Account:

Important Notes:

EarnWell Microfinance Bank offers multiple channels for customer support, available 24/7 for your convenience:

1. Phone Support:

2. Digital Channels:

3. Branch Network:

4. Self-Service Options:

5. Specialized Support:

Response Times:

Expert advice and tips to help you grow your business and manage finances better

“A new year will not change your money. Better decisions will. And better decisions start today.”

Let your new year’s financial resolution become actions. Here’s what I want you to do right now: Read this declaration out loud. Seriously. Say it

The compound effect of right decisions versus wrong decisions is the difference between financial stress and financial freedom.

At Earnwell Microfinance Bank, we’ve helped over 5,000 Nigerians avoid these mistakes and build genuine financial stability.

Let your new year’s financial resolution become actions. Here’s what I want you to do right now: Read this declaration out loud. Seriously. Say it

The compound effect of right decisions versus wrong decisions is the difference between financial stress and financial freedom.

Discover the proven 5-step roadmap to financial freedom in 2025. Learn how to set clear financial goals, master budgeting, build consistent savings with Earnwell Microfinance

At Earnwell Microfinance Bank, we’ve helped over 5,000 Nigerians avoid these mistakes and build genuine financial stability. Here’s how we support you: 1. Smart Savings

Open a Earnwell Savings Account MISTAKE #5: Keeping Money Where You Get No Guidance or Support The Costly Silence “I keep my money in [Bank

Stop making these 7 costly financial mistakes in 2026. Banking expert reveals how to avoid budget failures, debt traps, poor cash flow & more. Transform

Achieve lasting financial stability with these 6 proven strategies from banking experts. Learn how to build emergency funds, eliminate debt, automate savings, diversify income, invest